The federal Fair Labor Standards Act (“FLSA”), which applies to nearly all private-sector employers in the United States, establishes an important distinction between (1) non-exempt (a.k.a. hourly) workers, who are subject to the FLSA’s minimum wage and overtime requirements, and (2) exempt (a.k.a. salaried) workers, who are exempt from such requirements.

The most common FLSA exemptions (known as “white-collar exemptions”) are executive, administrative, professional, computer, and outside sales, based on two general requirements:

- Exempt Duties: Exempt employees must perform certain types of duties to qualify for an exemption.

- Compensation Method: Most exempt employees are paid on a “salary basis,” meaning that the employee receives a predetermined amount of compensation each pay period (currently at least $684 per week, which equals $35,568 per year) regardless of the quality or quantity of work performed, with limited exceptions. Certain types of exempt employees may be paid on a “fee basis,” meaning that the employee is paid a set amount for a single job regardless of the time required, provided that the employee receives the equivalent of the minimum salary threshold ($684/week). Limited types of exempt employees may be paid on an hourly or other basis, as discussed below.

Executive

To qualify for the executive exemption, an employee must (1) be primary responsible for managing the employer’s business or a recognized department or subdivision of the business; (2) regularly and customarily direct the work of two or more employees; and (3) have the authority to hire and fire employees or significant input regarding such decisions. This exemption is reserved for high-level employees who are responsible for the success or failure of the business operations under their management. Executive-exempt employees must be paid on a salary basis.

Administrative

To fall under the administrative exemption, an employee must (a) primarily perform office/non-manual work directly related to the management or operations of the business or its customers (e.g., back-office functions like accounting, marketing, human resources); and (b) exercise discretion and independent judgment with respect to matters of significance. Administrative-exempt employees may be paid on a salary basis or a fee basis.

Professional (Learned and Creative)

There are two distinct categories within the professional exemption: learned and creative. A learned professional must (i) primarily perform work requiring advanced knowledge; (ii) in a field of science or learning (e.g., law, medicine, accounting, engineering, architecture, teaching, science); (iii) that is customarily acquired by a prolonged course of specialized intellectual instruction (i.e., above a high school level). A creative professional’s primary duty must involve the performance of work requiring invention, imagination, originality, or talent in a recognized field of artistic/creative endeavor (e.g., music, writing, acting, graphic arts), as opposed to routine mental, manual, mechanical, or physical work. Professional-exempt employees may be paid on a salary basis or a fee basis.

Caveat: Highly Compensated Executive/Administrative/Professional Employees

A “highly compensated employee” with total annual compensation of at least $107,432 may also qualify for the executive, administrative, or professional exemptions if the employee performs at least one exempt duty. For example, an accounting employee who earns at least $107,432 per year may qualify for the administrative exemption even if the employee does not exercise the level of discretion and independent judgment normally required under the administrative exemption. Highly compensated employees may be paid on a salary basis or a fee basis.

Computer

To qualify for the computer exemption, an employee must have a primary duty that consists of (a) the application of systems analysis techniques and procedures to determine hardware, software, or system functional specifications; (b) the design, development, documentation, analysis, creation, testing or modification of computer systems or programs based on and related to user or system design specifications; (c) the design, documentation, testing, creation or modification of computer programs related to machine operating systems; or (d) a combination of the above. This exemption generally applies to high-level computer employees, not IT help desk personnel. Computer-exempt employees may be paid on a salary basis, a fee basis, or an hourly basis of at least $27.63 per hour.

Outside Sales

There are two requirements for the outside sales exemption: (1) the employee’s primary duty must be making sales or obtaining orders/contracts for goods/services; and (2) the employee must be customarily and regularly engaged away from the employer’s place of business (the employer’s place of business may be the employee’s home) while performing the primary duty. Unlike the other white-collar exemptions, there is no minimum compensation or compensation method for the outside sales exemption.

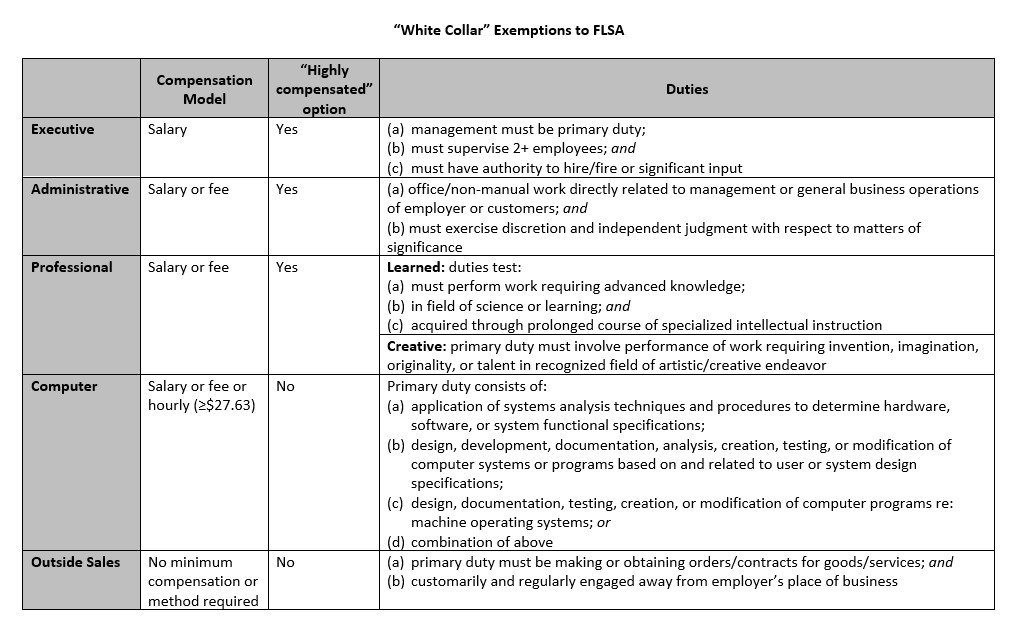

The following chart summarizes and compares the five white-collar FLSA exemptions:

If you have questions or concerns regarding FLSA exemptions or other employment matters, please contact Maureen Carr at mcarr@beankinney.com.

This article is for informational purposes only and does not contain or convey legal advice. Consult a lawyer. Any views or opinions expressed herein are those of the author and are not necessarily the views of any client.